How Bad Is It Really?

1. Zero int rates forever – The Fed acknowledged early in 2019 that they would not raise rates any more, (they were on hold) in 2019, then proceeded to cut rates three times. The Quant models looked at that as a positive when, in reality, it was just a trading algorithm factor. Lower rates for the last ten years have done almost nothing for real economic growth, but a lot for the real assets and the stock and bond markets.

2. This leads to reason #2, which is Corporate Stock Buybacks. Corporations buying back their stock not only provided support for the price of their stock but decreased the supply of shares in the open market, at a time when demand for stocks was rising. Extremely low-interest rates had pushed more investment dollars into the stock market, where they could earn dividend yields higher than the 10 yr US treasury yield. Add to this the fact that many companies did not have meaningful sales and earnings growth since 2012, but through buybacks were able to decrease their shares outstanding substantially enough to make their EPS go up, increasing demand for their shares. This was just a ploy by CEOs and their management teams to drive stock prices and hence the value of their options, assuring they get their payday. There were many companies that bought back their stock with free cash flow, and while this is not a bad thing, it is a bit disturbing that management thought buying back their own stock was a better investment than investing in their own business. That is not a vote for a better economy. Then many more companies started doing it by borrowing at extremely low-interest rates and ballooning their balance sheets with debt. This is great on the way up but scary on the way down. Finally, think about all those shares that were bought by companies in 2016-2019 that now sit on their balance sheets, underwater, a total destruction of capital.

3. Earnings – While earnings per share were climbing for reasons explained in #2, actual earnings had not grown much, for a majority of companies, over the last several years. In 2019, S+P 500 company Operating Earnings Per Share were flat or down 1% on average, while the S+P 500 rose over 30+%.

In summary, the virus was the catalyst for the selloff, but the markets were ready to fall. So, looking forward, what will and what should bring this market back are two different things. We are now in a bear market, and rallies tend to be opportunities for risk managers to sell positions and raise cash at better prices than a week earlier. This backing and filling has to happen, and traders are the ones who will do it. I will be watching to see how much money will be going into ETFs vs. individual names or mutual funds, but with over 50% of investing now in the passive mode, I would guess it will be ETFs. This will allow the traders to pull the plug quickly when they want to. If the market were to get back to 3000 on the S&P by year-end, as some are professing, I would be a seller. This rally will have less support than in 2019 and will correct again.

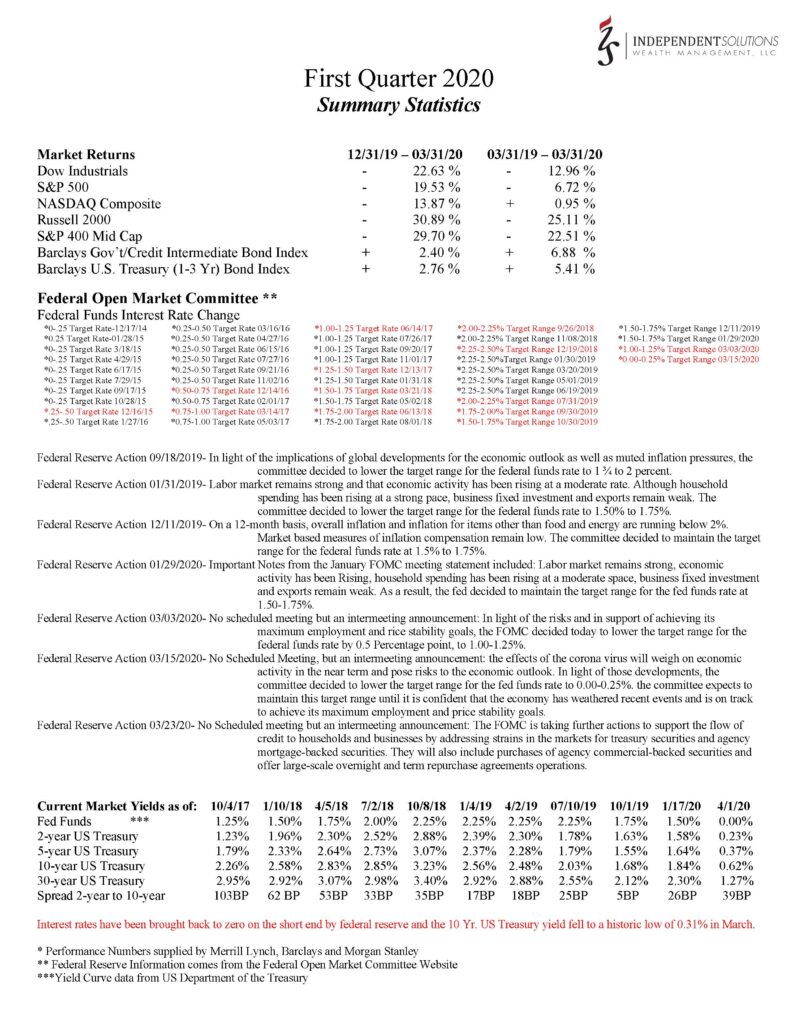

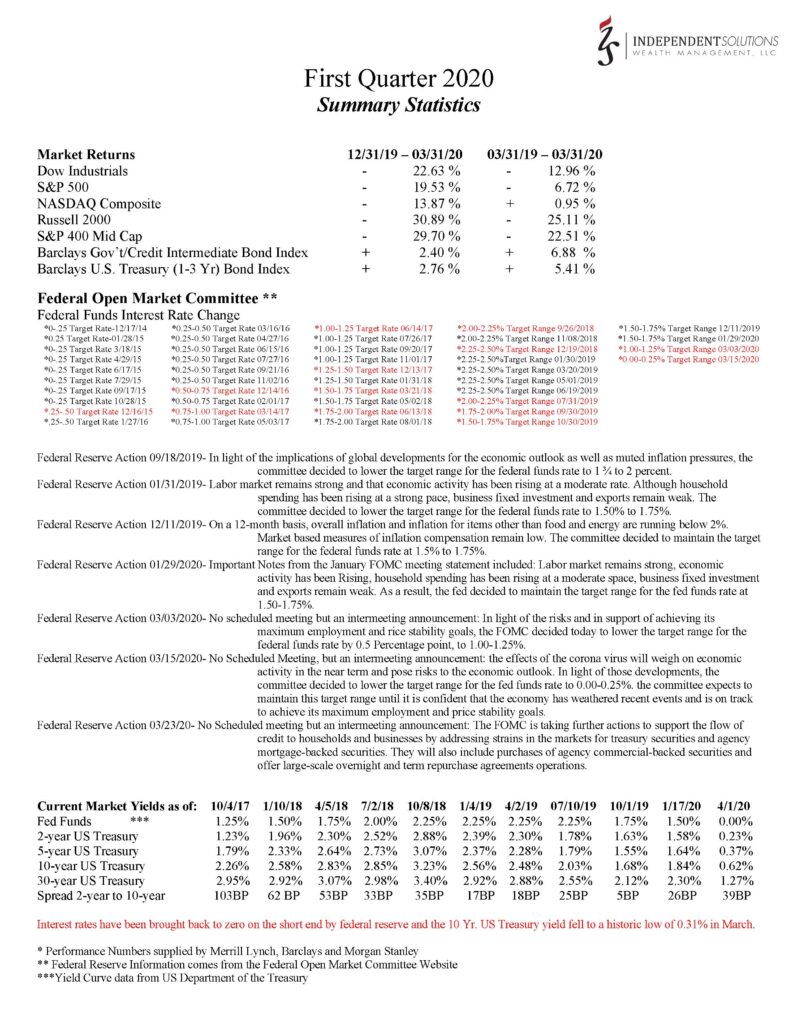

Access the First Quarter Summary Statistics be clicking the image below

I want to see what happens in Europe as they enter this recession. I am not sure they can work their way out because their interest rates are already below zero. I also what to see the magnitude of the U. S. recession, which I think will be severe in the short run, but due to the Fed actions of being the lender of last resort and buying back debt, including High Yield debt and other credit paper, will be shorter in duration. If it is not, it will be a setback. I also want to hear CEOs comment on how the virus and how the Government has responded with their economic shutdown and liquidity injections, will affect their business models in 2020 and 2021. We all know most companies will pull their earnings and sales guidance for 2020, but what we don’t know is, do they plan on laying off workers and cutting their Cap Ex spending and by how much.

What will be different going forward, and how will it affect our investment strategies and appetite for risk? The buybacks will be severely decreased going forward, and without that underlying support, the volatility in the markets will increase. I believe the Federal Reserve and central banks around the world have been debunked and are no longer a force to drive this market higher. They have fired all their bullets, as far as lowering interest rates to incentivize investing. I fear, worldwide debt, not only corporate but especially sovereign, will be a hindrance to economic growth and many countries will have to monetize their debt, creating inflation fears along with weakening credit and higher interest rates, in the longer end of the curve, which will keep the bubble from inflating. The huge amount of debt and government intervention into the capital markets should now be looked at as a problem, with no solution on the horizon.

In late 2008 there were many bear market rallies, some as much as 20%, but the market did not bottom until March of 2009. However, this time around, instead of the national debt of $7 Trillion, we have a national debt of $24+ Trillion. Congress just approved a $2 Trillion stimulus package that we cannot pay for, and the Fed Chairman professed to do whatever it takes to fight this virus. When you talk to older people, over 85-90, and ask when they have ever seen businesses shut down like this, they can only say in the 1930s Depression. However, they will tell you that what was different than was everyone lost everything. Everyone was in the same boat and had to buckle down, not throw anything out, take care of the things they had left, and take care of each other. They lived on the edge for a long time, and it shaped their lives and their way of thinking forever. I wonder how this experience, hopefully, another once in a lifetime event, will shape our and our children’s futures. We saw what happened in the 1930s, and we escaped that outcome in 2008-09, and it looks like a majority of people we will escape those results again this time. We need to be mindful that the damage did not go away; it has only been transferred in the form of huge amounts of debt around the world. Debt is a beast that can get out of control when there is no plan to bring it down in a reasonable amount of time.

Over the last ten years, I have been educating those of you who have been with me on the management of risk, both in your Stock and Bond portfolios. When the risks outweigh the returns, it is time to pull back and not chase returns, as tempting as it may be. I do not expect a V-shaped recovery; you may hear some people talking about, but I do think the markets will get oversold, and value will present itself. I am being patient and letting the market bring these deals our way. As you all know, I like it when the market readjusts itself because it creates opportunities for us. As we move forward, I will be aware of the changing risk profile in the marketplace and do what is necessary to help you participate as much as possible. On the upside, while always being careful to protect your assets on the downside.

Most importantly, though, I pray that you and your families are safe, staying healthy and enjoying each other’s company, in this rare moment of seclusion.

Stay well,

John E. Thur, CFA